Uncover More Deposit, Lending and Wealth Opportunities.

Clear the clutter with interVal’s automation and focus on activities that matter.

- Passive AUM growth

- Automate Annual Client Review activities

- Automate opportunity identification and product placement

- Elevate SMB growth and health

Let automation uncover opportunities linked to:

- Excess working capital

- Serviceable debt

- Investable assets

- Valuation

Learn how other Banks are leveraging interVal.

How does interVal work ?

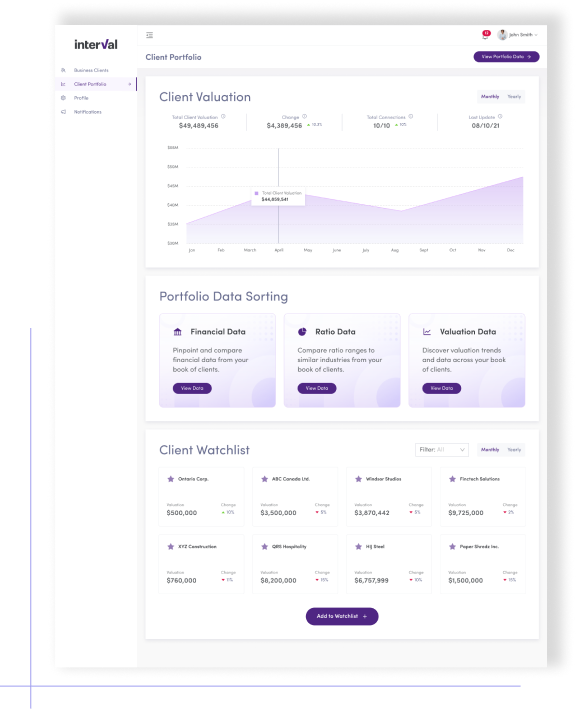

Uncover Hidden Growth Opportunities.

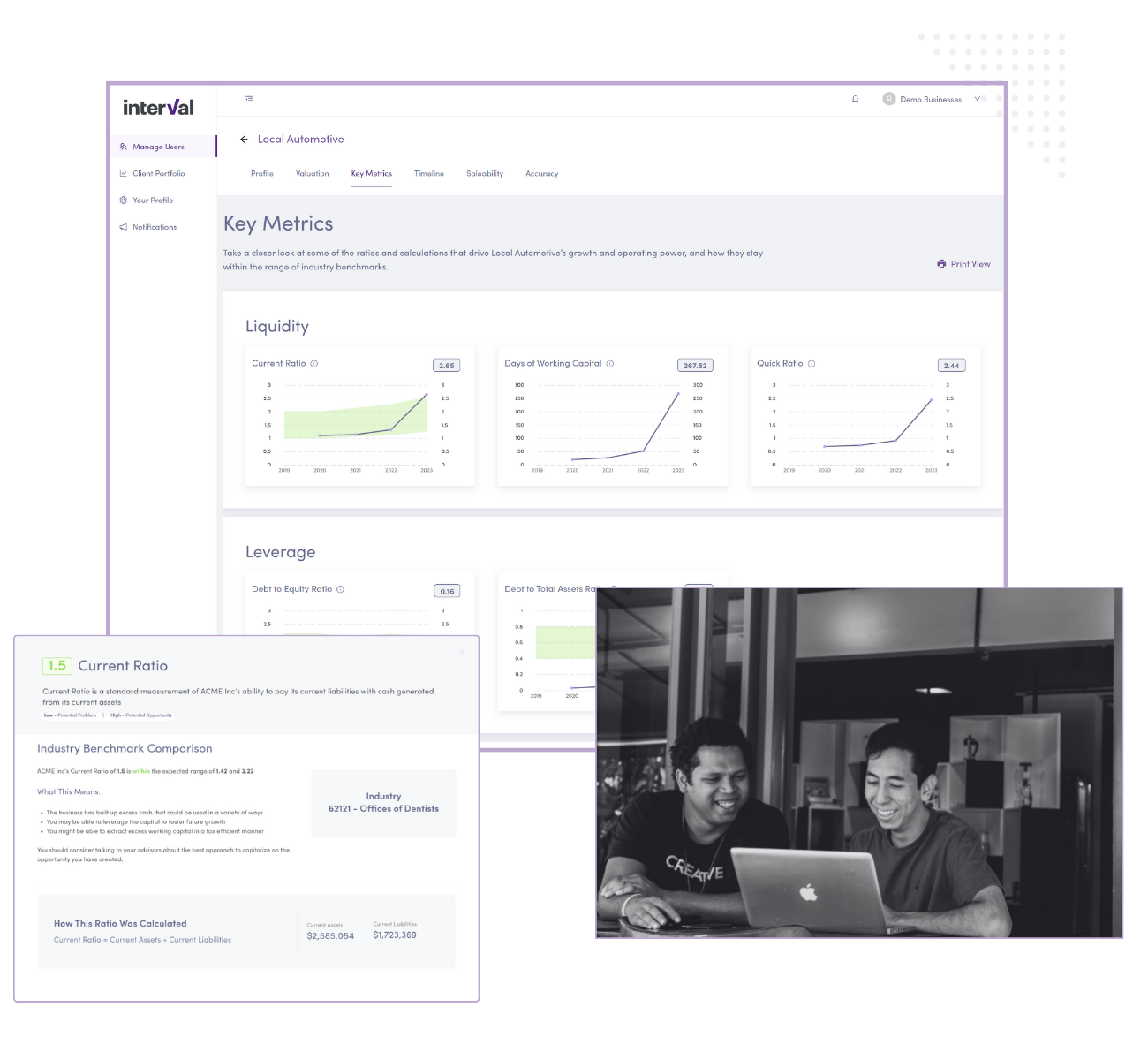

Attach to your existing processes and surface high-value opportunities to both you and your SMB customers:

- Key Metrics and benchmarks

- Valuation and Saleability Score

- Quantified advisory opportunities delivered to your CRM

- Business health and valuation feedback for SMBs to build better and stronger businesses

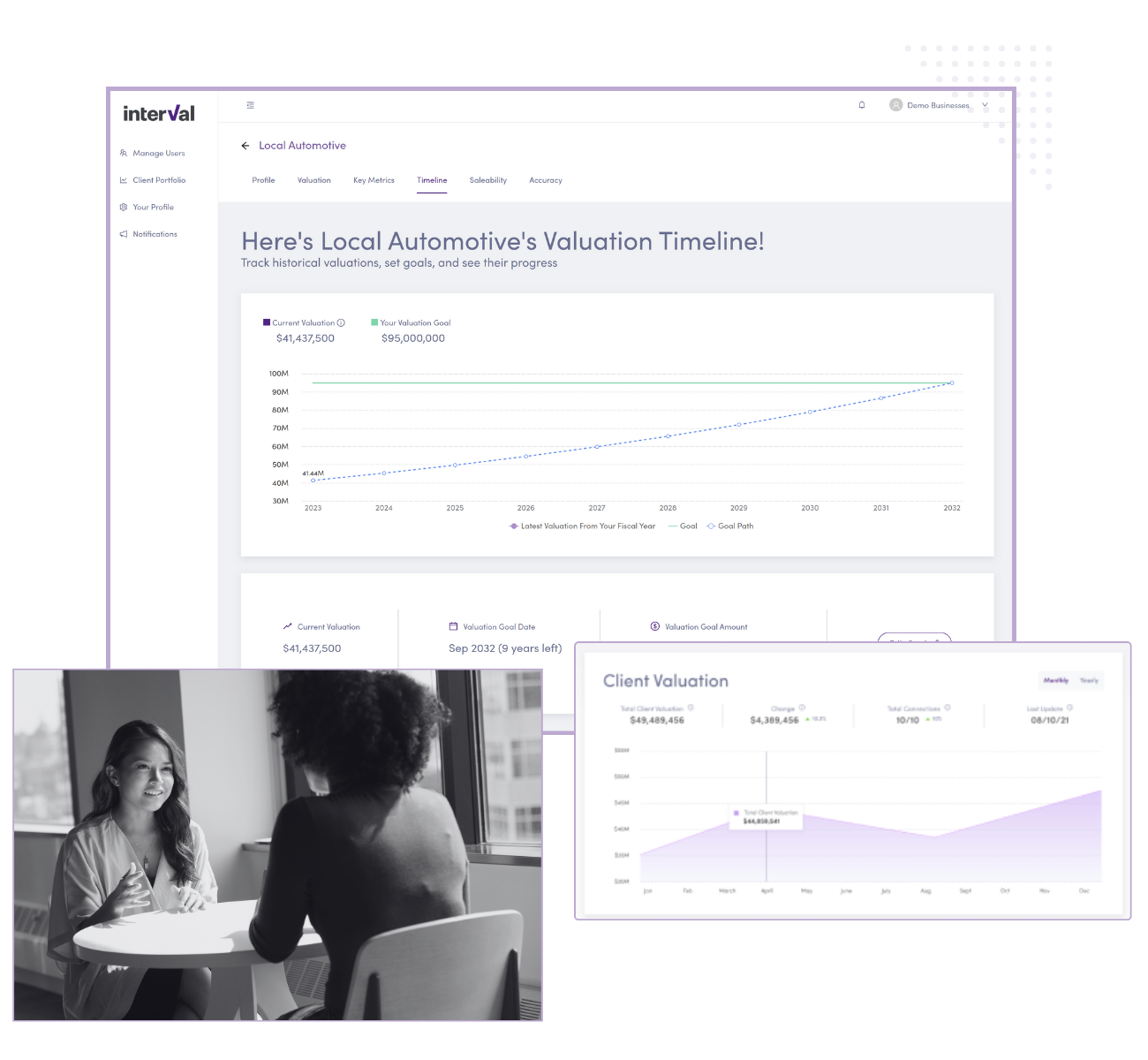

interVal is a “two-way” platform. This means financial advisors and their associated business owners can view the same information. Within minutes of granting a client access to the platform, following a brief onboarding process, highly visual and accurate actionable insights can be produced. Empower your SMB clients to make informed decisions and grow their business.

Optimize Outcomes.

interVal’s automation uncovers opportunities so you don’t have to.

Our powerful platform allows you to proactively advise your clients by seamlessly identifying the largest revenue opportunities from your existing SMB clients across lending, cash management, specialty products, and wealth & insurance - paving the way for a steadier stream of higher-margin services.

Healthier Businesses.

You can’t manage what you don’t measure. When connected to the platform, SMBs grow by 29% YoY. Everyone wins when your business owner clients thrive — they utilize more services and become lifetime customers.

FAQs.

-

How do I use interVal for cross-departmental referrals?

Growth opportunities are very often linked to other departments within an organization. For example, a Relationship Manager may work with their SMB clients on day-to-day cash management and advice, but interVal surfacing an opportunity for significant Excess Working Capital may drive a referral to your wealth team, as there may be investable assets to consider.

Relationship Managers are often the primary banking advisors for a business owner but are in a position to refer work to different departments when the opportunity arises. -

How much time does using interVal take?

interVal saves you time. The platform acts as an extension of your current systems and uncovers hidden growth opportunities for your SMB clients. With access to key financial health indicators, you can work with your SMB clients to support their financial goals and be a proactive advisor in their business ownership journey.

-

How does automation help my bank grow?

Financial Institutions are limited by time, people, and access to data. interVal empowers banks with automated insights to unlock AI-driven opportunities, allowing you to proactively advise your clients. interVal identifies opportunities for advisory in lending, investment management, succession planning, and insurance planning - paving the way for a steadier stream of higher-margin services.

Part of our coaching philosophy and effort to grow Owner prosperity includes delivering tools and technology to our business Owners so that they can focus on running their business. Using this tool, we can help member-Owners unlock real-time insight from accounting and other data they’re already producing.

Steve Bolton, Former Head Coach & CEO

.png?width=400&height=145&name=648762566027268c9a4f3fab_ValleyFirstLogo%20(1).png)

Using interVal with my members has opened up many conversations about their long-term goals and gives us a tool to track their progress over time. interVal is an easy way for us to provide existing and prospective members with a tangible way to understand their overall business health.

Bradley Byard, Business Banking Advisor

Hear what other customers are saying

Let's Connect.

Seeing our platform in action is the easiest way to see how interVal can help our partners with automation. If you want to ask questions, get a platform tour, and learn how other banks leverage interVal’s technology, we are here for you!