See the Signals Your Competitors Can’t.

Business owners will fuel your wealth-management firm's growth, but only if you see the moments that matter early. interVal is the Visibility Engine that surfaces business-owner signals years before they act, so you can start the right conversations long before anyone else.

Learn how other Wealth Management Firms are leveraging interVal.

You can’t grow what you can’t see.

Early Advisors Win.

Organic growth in wealth management is collapsing. The reality is, business owners are your firm's growth engine. But most advisors miss the early moments where relationships are won, because they can’t see what’s happening inside the business.

The Problem?

Financial planning and business planning run in parallel. That’s why advisors show up too late.

Owners make strategic decisions silently. Expansion, contraction, hiring, borrowing, selling, and advisors often hear about it after the fact.

If you’re not surfacing business value signals, you’re missing opportunities.

interVal changes that.

The Visibility Engine.

interVal isn’t a workflow tool or a reporting system. It’s a Visibility Engine, built to reveal business-owner signals years before they come to the surface.

With interVal, you can:

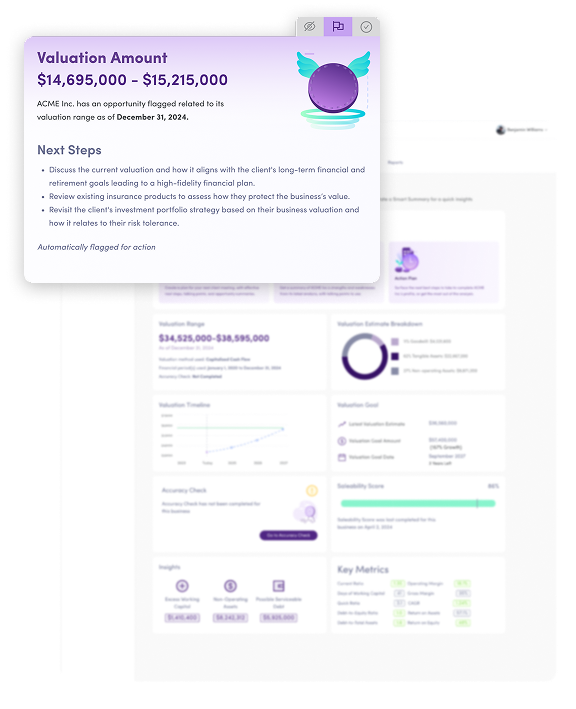

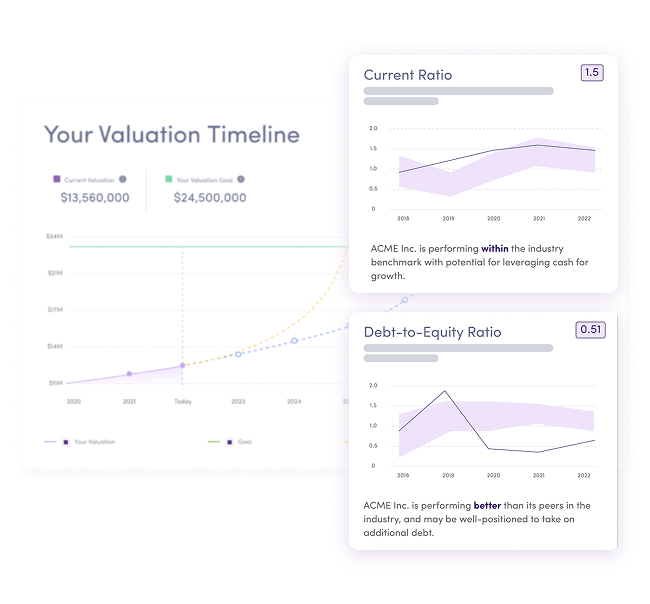

- See the leading indicators behind every business owner’s value, cash flow, and trajectory

- Know who’s approaching a planning moment years in advance

- Start critical conversations earlier than any competing advisor, and keep your clients in your book

- Walk in with clarity, intelligence, and the expertise your client expects

This is visibility that compounds.

IG Wealth Management Customer Story.

interVal’s Visibility Engine at scale. See what massive growth looks like.

IG Wealth Management used interVal to better understand and advise their business-owner clients, tracking real business health and valuation rather than guesses. With that insight, advisors had more strategic conversations, spotted protection gaps, and helped clients move wealth proactively, all while gaining a major AUM lift.

What You See With the Visibility Engine.

- Value and cash flow signals

Revealing whether a business is rising, plateauing, or at risk. - Leading indicators of upcoming planning moments

Succession, transitions, refinancing, expansions — visible years out. - Clarity on every business-owner client in your book

One unified view that removes guesswork and surfaces opportunity. - Signals that trigger timely conversations

So advisors can engage with confidence and relevance.

See the Signals. Start Earlier. Win More.

interVal is your Visibility Engine. Transform how you grow — starting today.

.png?width=243&height=148&name=Woodgate%20White%20(3).png)

interVal helped us bring business-owner conversations to life. It’s given our advisors the confidence to lead with insight, and that’s made all the difference.

Brent Allen, CFP, FMA, MBA | EVP Head of Sales & Distribution

IG Wealth Management

.png?width=250&height=250&name=Jason%20Pereira%20(2).png)

With interVal, we finally have a tool to give clients a realistic understanding of the value of their business, and the KPIs to maximize their enterprise value and develop more realistic plans for their future.

Jason Pereira | Sr Partner & Financial Planner

Woodgate Financial

There's a reason why we're in this industry, wanting to work with small business owners and entrepreneurs. Their success is our success, and interVal is really helping us help them.

Vanessa Salvador CPA, CA, LPA | Partner

Tino-Gaetani & Carusi

SOC 2 Type 2 Certified

Enterprise-grade security with annual audits, encryption, and comprehensive data protection protocols.

Frequently Asked Questions

-

How does automation help me grow my firm's AUM?

Wealth firms are limited by time, people, and access to data. interVal empowers wealth firms with automated insights to unlock AI-driven opportunities, allowing you to proactively advise your clients. interVal identifies opportunities for advisory in investment management, succession planning, liquidity events, and insurance planning - paving the way for a steadier stream of higher-margin services.

-

How much time does using interVal take?

interVal saves you time. The platform acts as an extension of your current systems and uncovers hidden growth opportunities for your SMB clients. With access to key financial health indicators, you can work with your SMB clients to support their financial goals and be a proactive advisor in their business ownership journey.

-

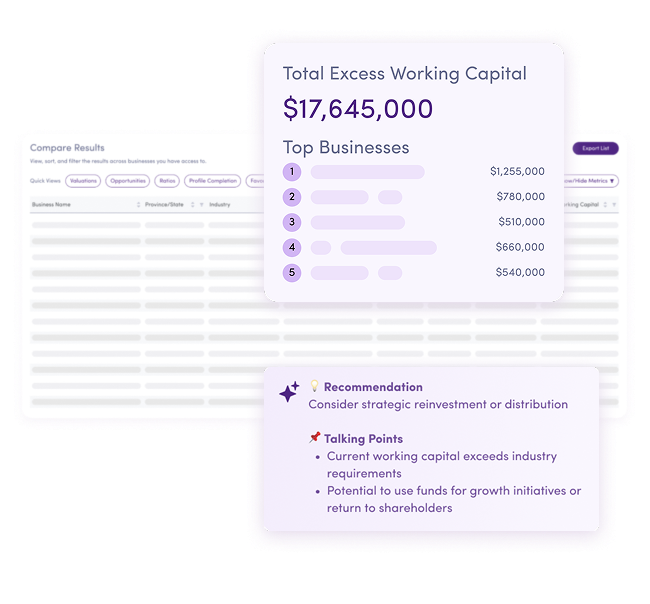

How do I use interVal for cross-departmental referrals?

You may come across growth opportunities within your client’s business that require a referral to another department within your organization. For example, you may work with your SMB clients on financial planning, but identify a significant investment opportunity when interVal flags a change in your client’s amount of Excess Working Capital. This may result in a cross-departmental referral to a specialized investment team that will help your client invest their redundant assets.