See the Signals Everyone Else Misses.

IDENTIFY EARLY AND WIN.

Banks don’t lose business because competitors are better; they lose it because competitors show up first.

interVal turns the data you already have into real-time visibility, early warnings, early opportunities, and early handoffs, so you lead conversations instead of reacting to them.

What you can identify early:

- Businesses preparing to expand or borrow

- Businesses experiencing stress or elevated risk

- Owners heading toward succession or sale

- Deposits at risk of flight

- Wealth and insurance opportunities months earlier

Help your team know where to show up, when to show up, and what to say, before anyone else gets in the door.

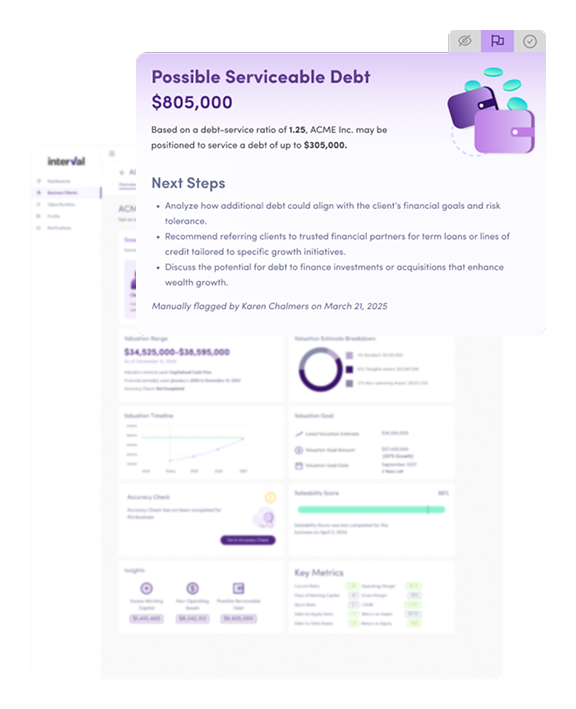

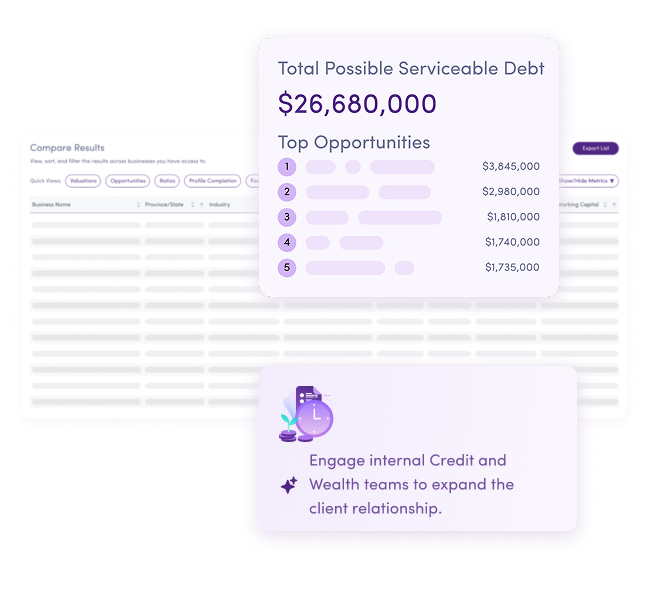

Your Existing Portfolio Is Your Growth Engine.

Your team doesn’t need more dashboards; they need to know which relationships need attention right now.

interVal continuously manages your SMB portfolio to highlight the clients most likely to grow, borrow, leave, or transition.

Bankers focus their time where it matters:

- Protecting deposits

- Winning lending opportunities before competitors arrive

- Initiating wealth conversations at the ideal moment

- Deepening full-bank relationships

Visibility drives efficiency, not the other way around.

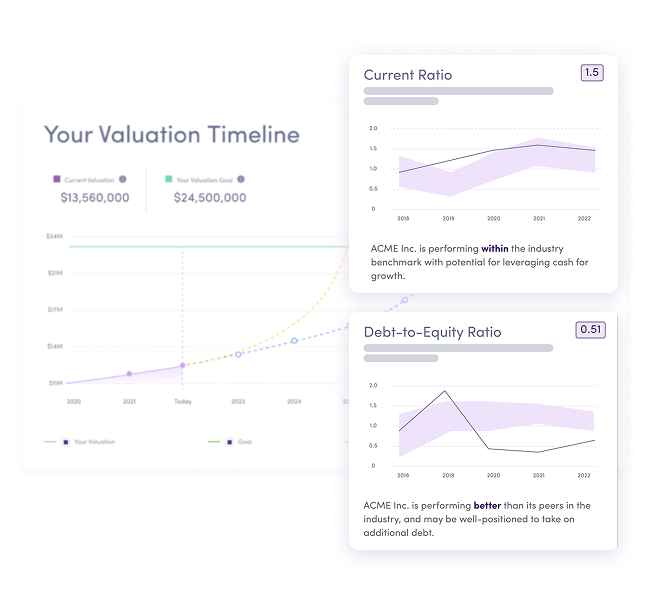

Healthier Businesses. Stickier Relationships.

Owners make better decisions when they understand their value. They expand sooner, borrow with confidence, and consolidate relationships.

interVal helps your clients grow, and growing businesses stay loyal.

Healthy businesses drive:

- More lending

- More deposits

- More treasury and specialty products

- More wealth referrals

- Higher lifetime value

Everyone wins when you’re early and when you help them grow.

Win Before Rate Enters the Conversation.

interVal's Visibility Engine helps banks deepen relationships and grow lending, deposits, and wealth referrals.

.png?width=243&height=148&name=Woodgate%20White%20(3).png)

interVal helped us bring business-owner conversations to life. It’s given our advisors the confidence to lead with insight, and that’s made all the difference.

Brent Allen, CFP, FMA, MBA | EVP Head of Sales & Distribution

IG Wealth Management

.png?width=250&height=250&name=Jason%20Pereira%20(2).png)

With interVal, we finally have a tool to give clients a realistic understanding of the value of their business, and the KPIs to maximize their enterprise value and develop more realistic plans for their future.

Jason Pereira | Sr Partner & Financial Planner

Woodgate Financial

There's a reason why we're in this industry, wanting to work with small business owners and entrepreneurs. Their success is our success, and interVal is really helping us help them.

Vanessa Salvador CPA, CA, LPA | Partner

Tino-Gaetani & Carusi

SOC 2 Type 2 Certified

Enterprise-grade security with annual audits, encryption, and comprehensive data protection protocols.

Frequently Asked Questions

-

How does interVal help my bank grow?

interVal gives you visibility into business-owner decisions long before they surface. Lending, deposit, and wealth opportunities appear months earlier, so your bankers can lead rather than react when price is the only lever.

-

How much time does using interVal take?

Very little. interVal works in the background, turning your existing data into actionable signals and banker-ready insights that guide conversations, and focus time where it moves the relationship.

-

How does interVal help Commercial and Wealth work together?

Signals naturally move across the bank:

Expansion → Lending

Profit Changes → Treasury

Succession → Wealth

Risk → Credit

interVal creates a shared visibility layer that brings Commercial and Wealth into the conversation early — not after the moment has passed.