See the Signals for More Advisory & More Growth.

Most firms believe their constraint is talent. The real constraint is client readiness. When business owners show up with unclear books, and no performance visibility, your team ends up reacting instead of advising.

interVal gives your firm the clarity to change that. You get early valuation and performance signals, you know who’s ready for strategic conversations, and your firm grows through advisory, not cleanup.

Learn how other Accounting Firms are leveraging interVal.

See the Signals Everyone Else Misses.

Uncover Growth Opportunities Earlier.

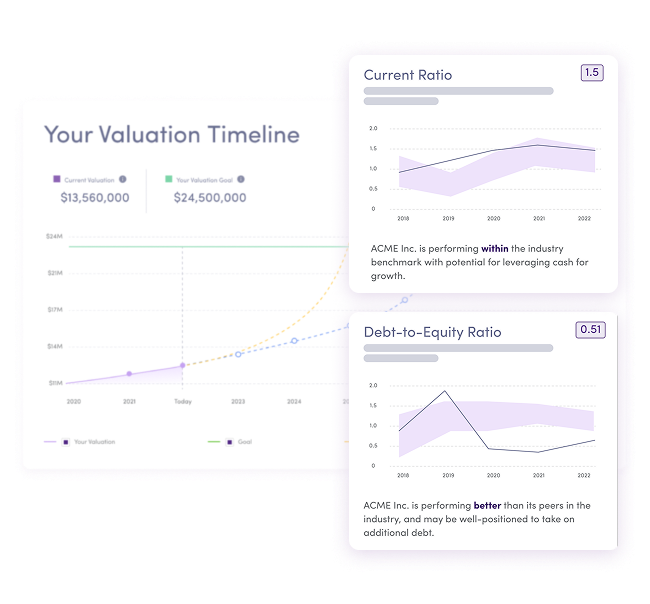

interVal connects directly to your workflow. We surface real-time valuation signals, performance trends, and business health insights for every client you serve. This clarity becomes a readiness filter. The right clients rise to the top.

Planning-minded businesses become obvious. Your team spends more time advising. You grow without adding headcount.

interVal is your Visibility Engine.

The Forward Thinking Firm.

Leading CAS and Advisory firms are rethinking how they create leverage. Not by hiring more talent. By improving client readiness.

This white paper published by Accounting Today shows how firms use valuation signals to:

- Prepare clients earlier.

- Create cleaner, more strategic engagements.

- Strengthen CAS as a bridge into advisory.

- Expand revenue without expanding their team.

- Deliver insights clients can act on today.

Your future growth depends on clarity, for your firm and for your clients.

Healthier Clients Create Healthier Firms.

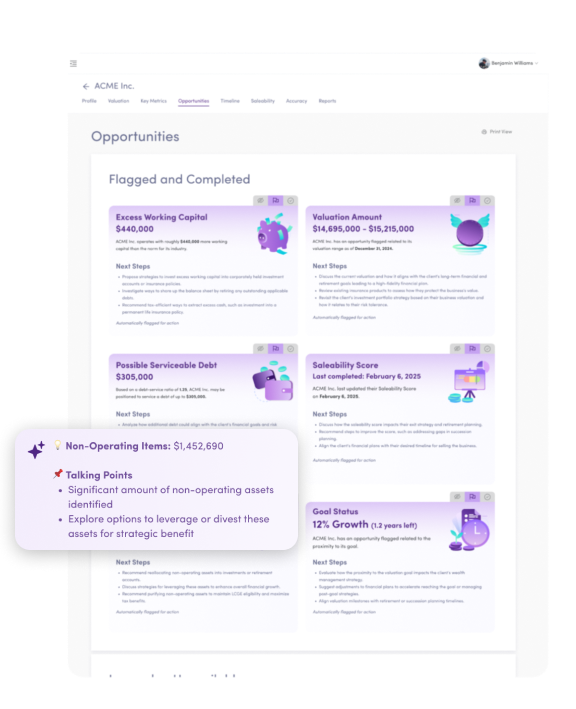

Clarity changes client behavior. When business owners understand their valuation, trajectory, and risks, they show up ready to plan, not just react. interVal helps clients see:

- How their business is performing.

- Where they stand in their industry.

- What’s driving value.

- What needs attention now.

- Which opportunities require action.

Prepared clients create better engagements. Better engagements create advisory growth. Advisory growth builds a stronger firm.

Know More. Grow More.

interVal gives your team and your clients the foresight they need to act earlier. With a clear view of valuation, trends, and performance signals, you can:

- Identify opportunities long before year-end.

- Anticipate planning moments.

- Guide succession and tax discussions.

- Elevate conversations from reporting to strategy.

- Unlock advisory revenue with clients who are ready.

You can’t grow what you can’t see. interVal gives you the visibility to change the trajectory of your firm.

See the signals. Start earlier. Win more.

interVal is your Visibility Engine. We’d love to show you how you can improve client readiness, elevate your advisory practice, prioritize strategic clients, reduce reactive work and create predictable growth — starting today.

.png?width=243&height=148&name=Woodgate%20White%20(3).png)

interVal helped us bring business-owner conversations to life. It’s given our advisors the confidence to lead with insight, and that’s made all the difference.

Brent Allen, CFP, FMA, MBA | EVP Head of Sales & Distribution

IG Wealth Management

.png?width=250&height=250&name=Jason%20Pereira%20(2).png)

With interVal, we finally have a tool to give clients a realistic understanding of the value of their business, and the KPIs to maximize their enterprise value and develop more realistic plans for their future.

Jason Pereira | Sr Partner & Financial Planner

Woodgate Financial

There's a reason why we're in this industry, wanting to work with small business owners and entrepreneurs. Their success is our success, and interVal is really helping us help them.

Vanessa Salvador CPA, CA, LPA | Partner

Tino-Gaetani & Carusi

SOC 2 Type 2 Certified

Enterprise-grade security with annual audits, encryption, and comprehensive data protection protocols.

Frequently Asked Questions

-

How does automation help with Advisory Services?

The platform automates the ingestion and analysis of your client’s financial data, saving you time combing through financials to identify changes or uncover additional advisory opportunities. interVal delivers actionable insights to you, allowing you to focus your time on delivering more value to more clients.

-

How much time does using interVal take?

interVal saves you time. The platform acts as an extension of your current systems and uncovers hidden growth opportunities for your SMB clients. In less than five minutes you can set up a business profile and submit data for analysis - and have actionable insights delivered to your inbox.

-

How does automation help me boost revenue?

interVal helps you move away from manual discovery, so you can take on more SMB clients with your current team size. You can service more clients, effectively and efficiently.