The Visibility Engine, Trusted Tool to Grow AUM in Less Time

interVal takes year-end documents and makes your next client INTERaction more VALuable

AI Data Extraction

Deciphering business data seamlessly. Upload year-end documents and watch interVal extract key insights instantly.

Insights That Matter

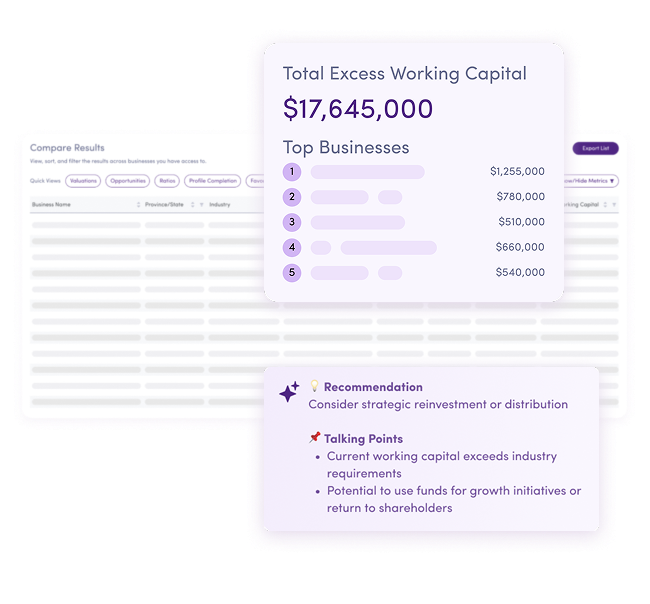

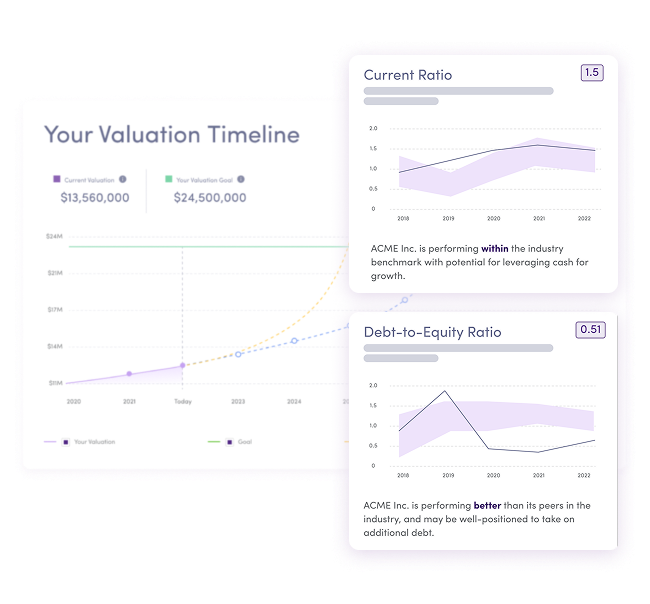

The talking points you need to give great advice. Valuation trends, business health metrics, and protection gaps at a glance.

Client Ready Deliverables

Generate reports to deliver immediate and tangible value. Turn complex data into clear, compelling presentations.

interVal for Wealth Management.

Unlock smarter growth.

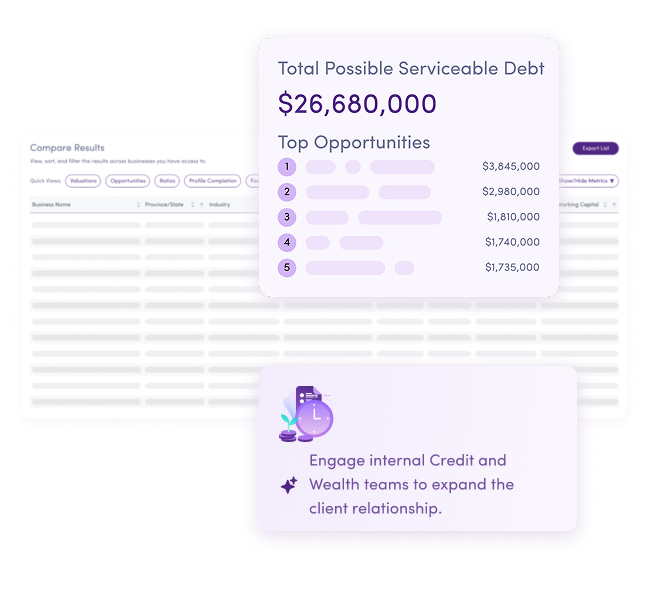

Business owners are the key to the next wave of growth, and interVal helps you unlock it. Our Wealth Advisory technology automatically surfaces investment and insurance opportunities across your SMB client base, helping you grow AUM without chasing data.

Grow two ways: deepen existing relationships or unlock new ones. interVal helps you do both.

interVal for Accounting.

Advisory, on autopilot.

interVal turns every accountant into a truly proactive advisor. Business owners now expect more from their advisors, and interVal helps firms multiply their impact.

Our Accounting Advisory technology automates insights for your SMB clients and signals when to bring the right expertise to the table, so your team delivers more value, in less time.

98%

of business owners don't know the current valuation of their business.

85%

of a business owner’s wealth lives inside of their business

75%

of business owners plan to exit over next decade.

17%

of financial services providers give advice that is fully aligned with a small business’s goals

interVal helped us bring business-owner conversations to life. It’s given our advisors the confidence to lead with insight, and that’s made all the difference.

Brent Allen, CFP, FMA, MBA | EVP Head of Sales & Distribution

IG Wealth Management

.png?width=250&height=250&name=Jason%20Pereira%20(2).png)

With interVal, we finally have a tool to give clients a realistic understanding of the value of their business, and the KPIs to maximize their enterprise value and develop more realistic plans for their future.

Jason Pereira | Sr Partner & Financial Planner

Woodgate Financial

There's a reason why we're in this industry, wanting to work with small business owners and entrepreneurs. Their success is our success, and interVal is really helping us help them.

Vanessa Salvador CPA, CA, LPA | Partner

Tino-Gaetani & Carusi

.png?width=243&height=148&name=Woodgate%20White%20(3).png)

SOC 2 Type 2 Certified

Enterprise-grade security with annual audits, encryption, and comprehensive data protection protocols.

Frequently Asked Questions

-

What is interVal?

interVal is a leading SaaS that empowers Accounting Firms, Wealth Management Firms and Financial Institutions with automated insights to unlock opportunities and drive optimal growth for their SMB clients. The platform leverages AI to deliver actionable intelligence, streamline processes, and enhance decision-making capabilities. interVal makes it possible for business owners and their advisory partners to jointly identify, monitor, and leverage automated insights in a single, shared environment.

-

Who uses interVal?

Banks, wealth management firms, accounting firms, and other financial institutions use interVal. Trusted advisors within these organizations can gain access to actionable insights through interVal — AND you can invite your SMB clients to the platform, empowering them to understand their overall business health and track their growth over time.

-

How do I safely upload data?

You can upload standard pdfs into the platform, or use one of our many cloud integrations (Quickbooks Online (QBO), Xero, Sage, and Caseware).

-

Does interVal help me save time?

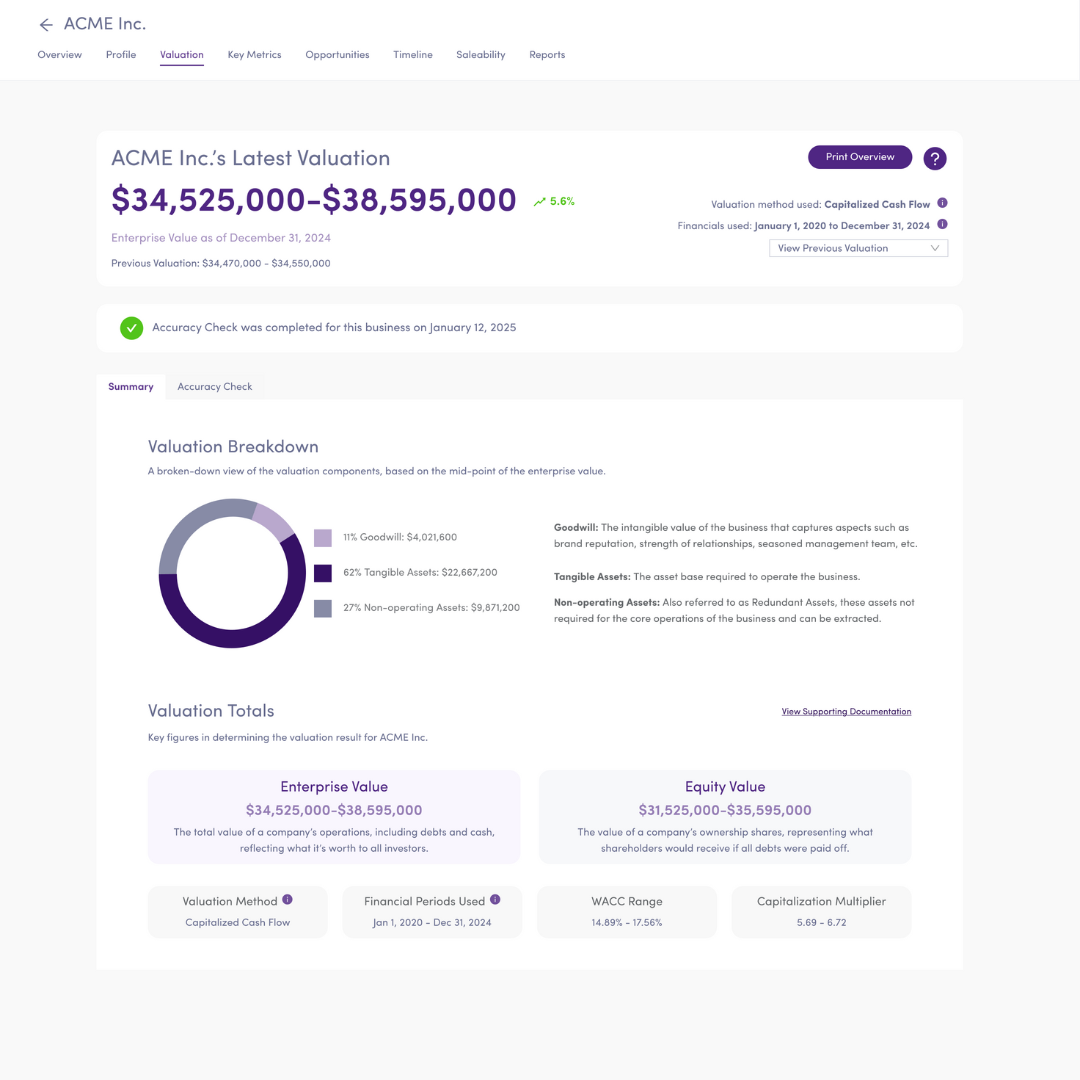

interVal automates the discovery of financial data for advisory services, saving you the manual labour of sifting through data to find opportunities for growth within your SMB client’s business. The platform provides you with easy-to-find and seamlessly organized key insights and opportunities regarding your SMB client’s financial health; including valuation, key metrics, loan opportunities, excess working capital, saleability score, and more.

-

How do the calculations work?

interVal uses a combination of machine learning and natural language processing models (AI) to categorize data from financial statements. This data is then used to perform calculations, surface actionable insights, and compare the data against industry benchmarks. Curious how we got to a number? Don't worry we show our work.

-

How is financial data stored and secured?

interVal is fully hosted in AWS data centers in US and Canada regions to provide high availability. AWS maintains annual certifications and 3rd party audit reports including PCI DSS Level 1, ISO 27001, FISMA Moderate, FedRAMP, HIPAA, and SOC 1 & SOC 2.

System and Organization Controls (SOC) Reports are independent, 3rd party examination reports that demonstrate how interVal achieves key compliance controls and objectives. interVal isSOC-2 Type 2 certified, and performs an annual audit to maintain this certification.

-

What does success look like?

We’ve got you covered from day one: Our customer success team supports your interVal implementation to ensure that the roll-out is seamless and simple. Our support team provides access to resources via our online Help Center, in-app education, and email and live chat support.

-

Who quickly can I get set up?

interVal requires very little training and is a very user-friendly platform. Once partners have access to the platform, they can start setting up business profiles right away. Our ongoing Customer Success efforts ensure that you feel supported every step of the way.

-

Is the platform evolving?

interVal is fast-growing and new features and enhancements are constantly in development. Advisor and Business Owner feedback is essential to the future of our product; we work closely with our users to understand where the platform can drive additional value in the future.

Platform users have access to a "Feature Request" form that can be used to send over ideas or recommendations and make feedback as easy as possible.